Ship Shape Covers Compliance, Employment & Payroll

You focus on Growth

We’ll cover compliance, employment & payroll;

You focus on Growth

As a ‘tech savvy’ business, the invaluable experience gained during our 18 years of supporting agencies, through the turmoil of multiple legislative changes, Brexit and covid, we continue to provide efficient and effective support that enable agencies to focus on growth.

We’re not biased or pushy; you choose the employment and payroll model that you prefer for your business. Whichever one you choose, we are big enough to cope and small enough to care.

Our experience will support and protect you from any potential financial penalties, reducing your risks of IR35 related penalties.

Hassle free support that is 100% compliant, no compromise.

Visible payment trail starting from you, through intermediaries, to a workers pay

No compliance risks with Ship Shape

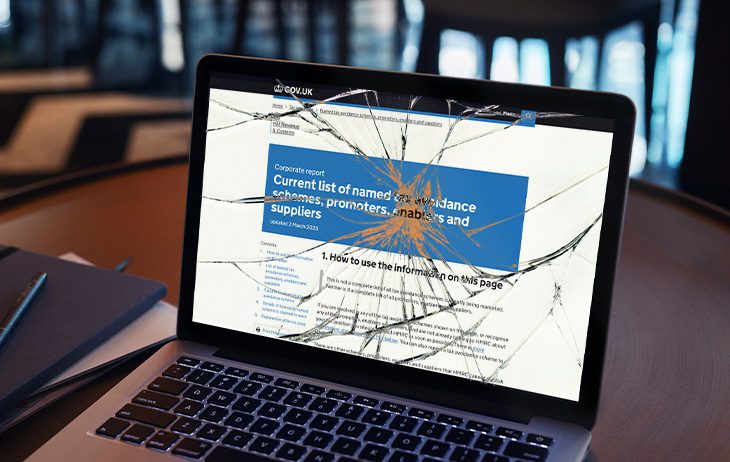

Changes in legislation have now placed ‘End Hirers’, companies using contractors either directly or through intermediaries such as recruitment agencies, at risk of fines and reputational damage if all contractor taxes are not correctly deducted and paid to HMRC.

End Hirers must now provide a Status Determination Statement (SDS) to intermediaries which, if they in-turn do not pass it down the supply chain and taxes are not deducted and paid correctly, HMRC will ultimately demand payment from you if they cannot obtain it from point of breach.

End Hirers will be liable to pay any underpaid tax liabilities when:

- They have failed to issue an SDS;

- They have failed to use reasonable care in preparing an SDS;

- They have failed to deal with an appeal/challenge to SDS; and

- If the fee payer has received a compliant SDS but simply doesn’t pay the tax due

With UK Government naming and shaming companies who breach National Minimum Wage regulations, it will not be long before HMRC do the same.

With Ship Shape, you get a visibly transparent and auditable supply chain, removing your risks and protecting your reputation.

Proudly Supporting

We are committed to supporting Young Lives vs Cancer, see how our payroll donations are helping

Seas the Day

Copyright 2022 Ship Shape Resources Ltd